Can I Deduct Home Office In 2024

Can I Deduct Home Office In 2024 – The following questions will help you determine if you can deduct the cost of your home office shed — or any Flakes Are Most Likely to Fly 7-Round 2024 NFL Mock Draft: Drake Maye, Caleb . All of that may make you wonder whether you can claim a home office tax deduction for your expenses on your federal income tax return. Read on for some answers. Some people who work from home can .

Can I Deduct Home Office In 2024

Source : news.yahoo.com

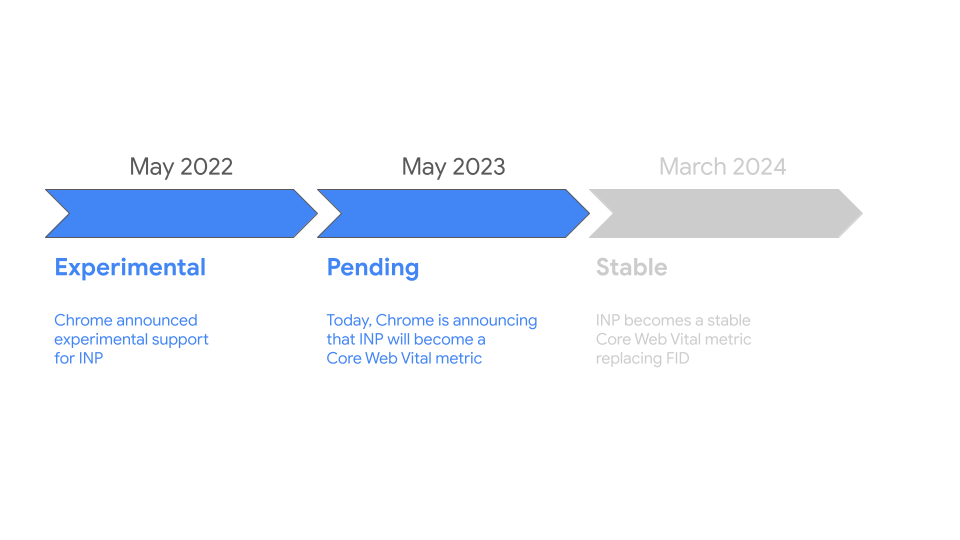

Introducing INP to Core Web Vitals | Google Search Central Blog

Source : developers.google.com

Home Office Deductions Tax Tips YouTube

Source : m.youtube.com

Maximize Earnings: Must Know Tax Deductions for Freelancers in

Source : medium.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

Kathy J. Wills, CPA

Source : m.facebook.com

The Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Dawn Hooper, NACA In House Realtor

Source : www.facebook.com

What Is the IRS Standard Deduction for 2023 and 2024?

Source : www.businessinsider.com

Sink Gordon Accountants & Advisors LLP | Manhattan KS

Source : www.facebook.com

Can I Deduct Home Office In 2024 IRS announces 2024 income tax brackets – see where you fall: How much can you write off for a home based business? If you work from home, you may be able to deduct a portion of your housing costs from your business income. A home office expense can be deducted . Finally, if you are an employee, and not a business owner, you can only deduct the costs of your home office if your employer requires you to work there. If your employer gives you an office in .